A Biased View of What Is Medigap

Little Known Facts About Medigap Benefits.

Table of ContentsThe Main Principles Of How Does Medigap Works The smart Trick of Medigap That Nobody is DiscussingGet This Report on What Is MedigapHow Does Medigap Works for BeginnersThe Ultimate Guide To What Is MedigapSome Known Factual Statements About What Is Medigap

A (Lock A secured padlock) or indicates you've safely linked to the. gov website. Share delicate details only on authorities, protected internet sites.What really surprised them was the realization that Medicare would not cover all their healthcare expenses in retirement, including those when taking a trip abroad. "We travel a lot and also want the safety of knowing we can get medical therapy away from residence," says Jeff, who with Alison is eagerly anticipating seeing her family in England.

"Talk to your doctor concerning aging as well as take a look at your household history," says Feinschreiber. Since there is no "joint" or "household" insurance coverage under Medicare, it might be extra expense reliable for you as well as your spouse to pick various protection choices from separate insurance coverage firms.

A Biased View of Medigap

The Ottos recognize that their demands might alter gradually, especially as they cut travel strategies as they age. "Although we have actually seen boost over the last 2 years because we registered in Medigap, we have the best degree of extra protection in the meantime and also believe we're obtaining great value at $800+ each month for the both people consisting of dental insurance coverage," stated Alison.

For citizens in choose states, sign up in the best Medicare plan for you with aid from Fidelity Medicare Services.

Not every plan will be offered in every state. Medicare Supplement Insurance is marketed by exclusive insurance provider, so the expense of a plan can differ between one service provider or area as well as another. There are a couple of other things that might affect the cost of a Medigap strategy: The amount of protection used by the strategy Whether or not clinical underwriting is used as component of the application process The age at which you join the plan Eligibility for any kind of discount rates provided by the provider Sex (women often pay less for a strategy than guys) In order to be eligible for a Medicare Supplement Insurance strategy, you should go to the very least 65 years of ages, enlisted in Medicare Component An and Component B and reside in the location that is serviced by the plan.

The Only Guide for Medigap

You are signed up in a Medicare Advantage or Medigap plan provided by a company that misled you or was found to have actually not adhered to specific regulative policies. Medicare Supplement strategies as well as Medicare Advantage plans job really in different ways, as well as you can't have both at the same time. Medicare Supplement plans job together go right here with your Original Medicare coverage to help cover out-of-pocket Medicare costs like deductibles and coinsurance.

Several strategies likewise provide other advantages such as prescription medication protection or dental treatment, which Original Medicare does not typically cover. Medicare Supplement strategy premiums can vary based on where you live, the insurance policy firms using plans, the rates framework those companies use and also the type of plan you use for.

The typical regular monthly premium for the very same plan in Iowa in 2022 was only $120 each month. 1 With 10 different sorts of standard Medigap strategies and also a series of advantages they can her latest blog supply (and also the variety of monthly costs for each plan), it can be helpful to take the time to compare the Medigap options available where you live - medigap.

Facts About Medigap Uncovered

You must think about switching over Medigap plans throughout specific times of the year, however. Changing Medicare Supplement prepares throughout the correct time can help secure you from needing to pay higher premiums or being denied insurance coverage because of your health or pre-existing problems. There are a number of various Medicare Supplement Insurance coverage business throughout the nation.

You can find out more regarding them by contrasting firm ratings as well as reading consumer reviews. Medigap Strategy F covers extra out-of-pocket Medicare prices than any various other standardized sort of Medigap plan. In exchange for their monthly costs, Strategy F recipients recognize that all of their Medicare deductibles, coinsurance, copays and also various other out-of-pocket expenses will be covered.

His posts are weblink read by thousands of older Americans each month. By much better understanding their health and wellness care coverage, visitors might hopefully discover just how to restrict their out-of-pocket Medicare spending and gain access to top quality clinical treatment.

Getting My What Is Medigap To Work

Throughout that time framework, insurer are generally not permitted to ask you any type of health inquiries (additionally called medical underwriting). Afterwards, you may have to address those concerns, and the solutions may bring about a greater costs or to being declined for Medigap insurance coverage. A few exemptions exist.

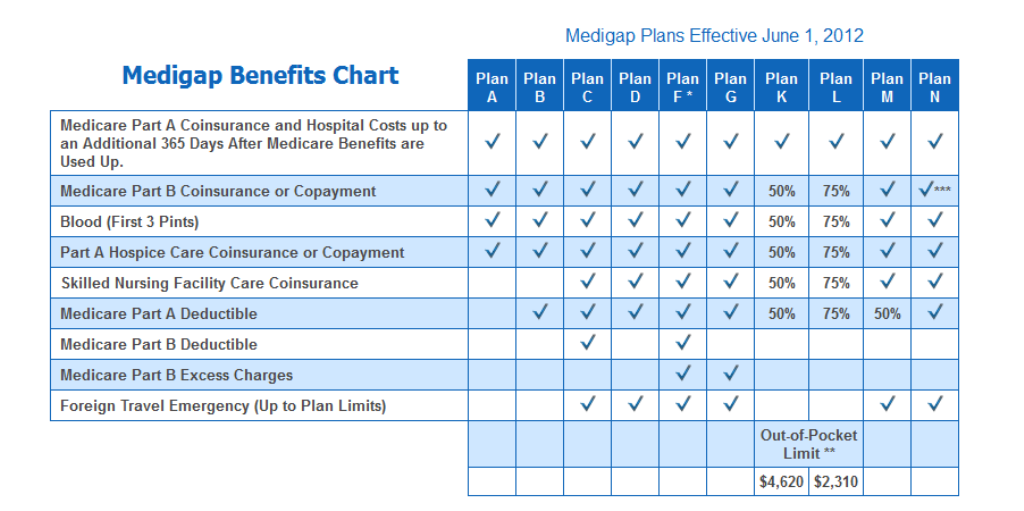

This is true only if they drop their Medicare Advantage coverage within 12 months of authorizing up. That depends on the strategy you pick. Medigap has 10 standardized insurance policy strategies that are recognized with letters of the alphabet: Strategies A, B, C, D, F, G, K, L, M and also N.

Getting My Medigap Benefits To Work

However, nonetheless each plan, the benefits are advantages same because exact same due to the fact that standardized.